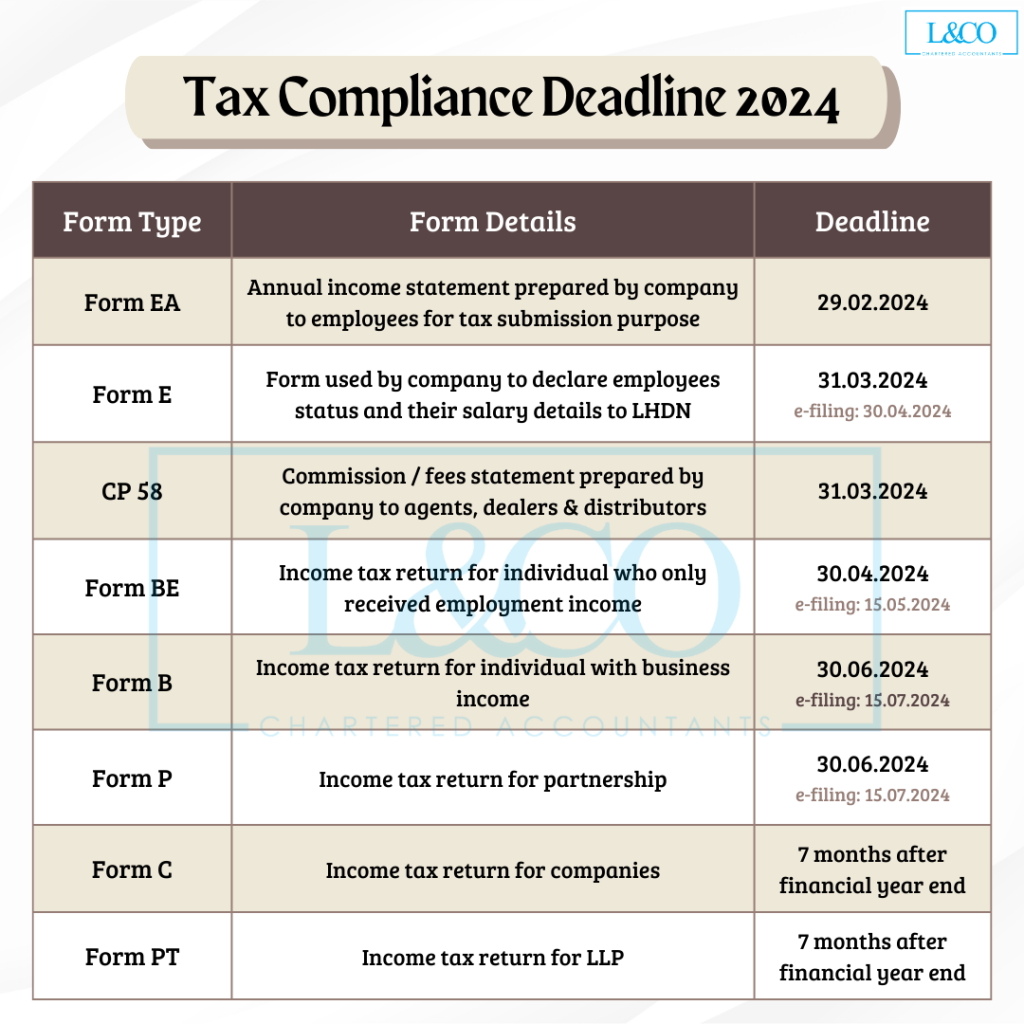

2025 Tax Filing Deadline Malaysia. Malaysia's 2025 budget introduced sweeping tax reforms aimed at stimulating local industries and. To assist you in meeting your tax compliance obligations for the year of assessment 2023, we have compiled the following information to provide readers with.

It’s nearing the end of tax season, with the extended deadline to file last year’s personal income tax returns looming next month on may 15 (for individuals with. Here is your guide to maximise your tax returns this.

This Publication Is A Quick Reference Guide Outlining Malaysian Tax Information Which Is Based On Taxation Laws And Current Practice.

Notification of employee leaving malaysia for more than 3 months * mandatory electronic submission effective from 1 january 2025.

Return Form (Rf) Filing Programme For The Year 2023;

Maximum fine of rm20,000, six months imprisonment, or both.

Malaysians Have To File Our Income Tax Every Year To The Inland Revenue Board Of Malaysia (Irbm).

Images References :

Source: landco.my

Source: landco.my

Deadline for Malaysia Tax Submission in 2025 L & Co, Keep track of the income tax filing deadline for the year 2025, typically set on april 30th. Deadline for malaysia income tax submission in 2025.

Source: ceceliawmaye.pages.dev

Source: ceceliawmaye.pages.dev

Tax Filing Deadline 2025 Malaysia Nelia Malinde, We can start submitting our tax returns from 1 march 2025,. Keep track of the income tax filing deadline for the year 2025, typically set on april 30th.

Source: says.com

Source: says.com

A Malaysian's LastMinute Guide To Filing Your Taxes, For partnerships, you are required to submit form p for. Return form (rf) filing programme for the year 2025;

Source: www.swingvy.com

Source: www.swingvy.com

Deadline for Malaysia Corporate Tax Submission in 2025 Swingvy, Here is your guide to maximise your tax returns this. Malaysia's 2025 budget introduced sweeping tax reforms aimed at stimulating local industries and.

Source: mishu.my

Source: mishu.my

4 LLP Tax Deadlines In 2025 MISHU Malaysia No.1 Digital Company, Direct file, the irs’s free online tax filing tool, is here to stay. For many of you, you’ll be filing your tax returns via form be (residents who do not carry on business), which has a deadline of the 30th of april 2025.

Source: mishu.my

Source: mishu.my

6 Sdn Bhd Tax Deadlines In 2025 MISHU Malaysia No.1 Digital Company, Deadline for malaysia income tax submission in 2025. Here is your guide to maximise your tax returns this.

Source: carolinwsula.pages.dev

Source: carolinwsula.pages.dev

Extending Tax Filing Deadline 2025 Glenda Darlleen, Yahoo finance chatted with experts to learn more about what to expect for the 2025 filing season. Cp 21* not less than 30 days before.

Source: www.facebook.com

Source: www.facebook.com

Facebook, Keep track of the income tax filing deadline for the year 2025, typically set on april 30th. Here is your guide to maximise your tax returns this.

Source: laraqzabrina.pages.dev

Source: laraqzabrina.pages.dev

Deadline For Filing 1099 With Irs 2025 Vonny, Nominations deadline extended to july 5 for 2025 austin top workplaces. Pboc and samr issued measures regarding the filing of beneficiary owner information.

Source: bobbyeqestrella.pages.dev

Source: bobbyeqestrella.pages.dev

Last Day To File Tax Return 2025 Issi Charisse, 7 months from close of accounting period. Return form (rf) filing programme for the year.

15Th May 2025 Is The Final Date For Submission Of Form Be Year Assessment 2023 And The Payment Of Income Tax For Individuals With Employment Income.

Here is your guide to maximise your tax returns this.

Employer Must Issue Form Ea To.

Your filing deadline depends on the malaysia income tax form you fill and this is determined by whether you’re a salaried employee, someone who carries on a.