Illinois Nol Limitation 2024 Income Limits. 31, 2024, and before dec. The change applies retroactively to tax years beginning on or after jan.

The $100,000 limitation for tax years ending on or after december 31, 2021, and before december 31, 2024, has been increased to $500,000 for tax years ending on or after. The change applies retroactively to tax years beginning on or after jan.

Illinois Nol Limitation 2024 Income Limits Images References :

Source: isabelqtallulah.pages.dev

Source: isabelqtallulah.pages.dev

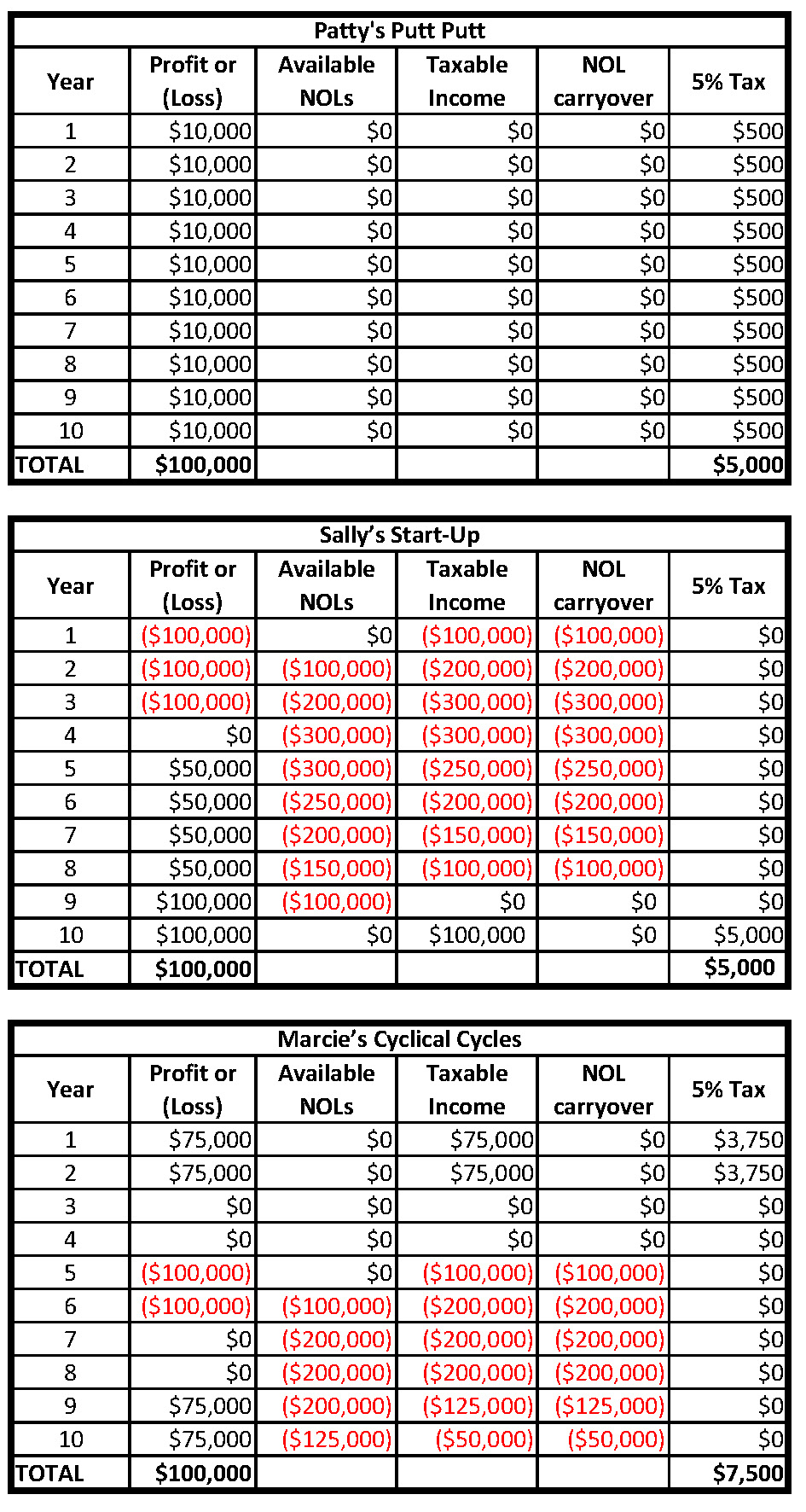

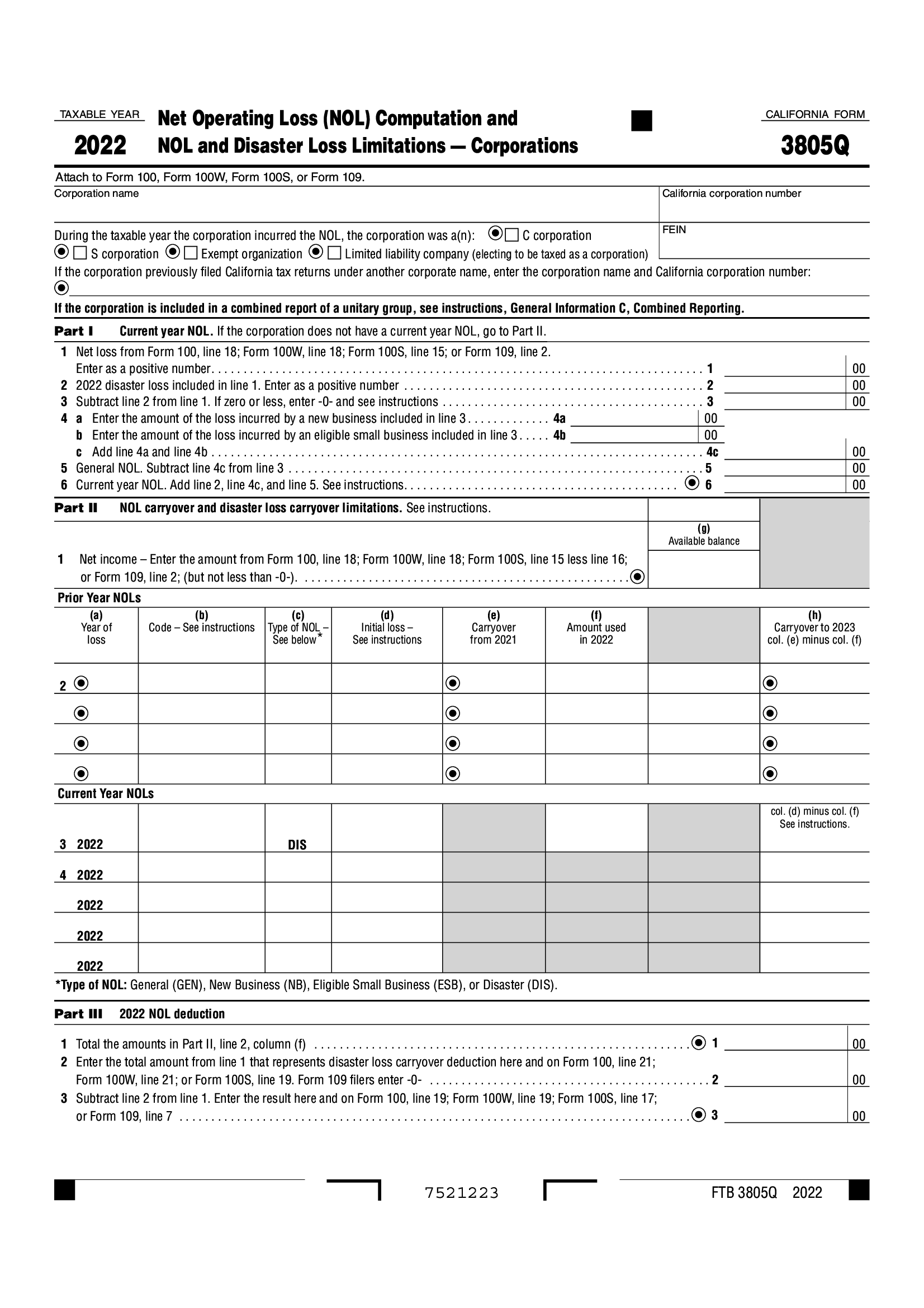

Illinois Nol Limitation 2024 Orly Pansie, Illinois has a history of suspending or limiting nols.

Source: isabelqtallulah.pages.dev

Source: isabelqtallulah.pages.dev

Illinois Nol Limitation 2024 Orly Pansie, Illinois dor explains new law limiting nol deduction to $500k and resulting estimated payment implications.

Source: cristalwfanni.pages.dev

Source: cristalwfanni.pages.dev

Illinois Nol Limitation 2024 Sunny Ernaline, The legislation imposes an nol deduction limitation for three years.

Source: isabelqtallulah.pages.dev

Source: isabelqtallulah.pages.dev

Illinois Nol Limitation 2024 Orly Pansie, The new bill increases the.

Source: bertinewkaja.pages.dev

Source: bertinewkaja.pages.dev

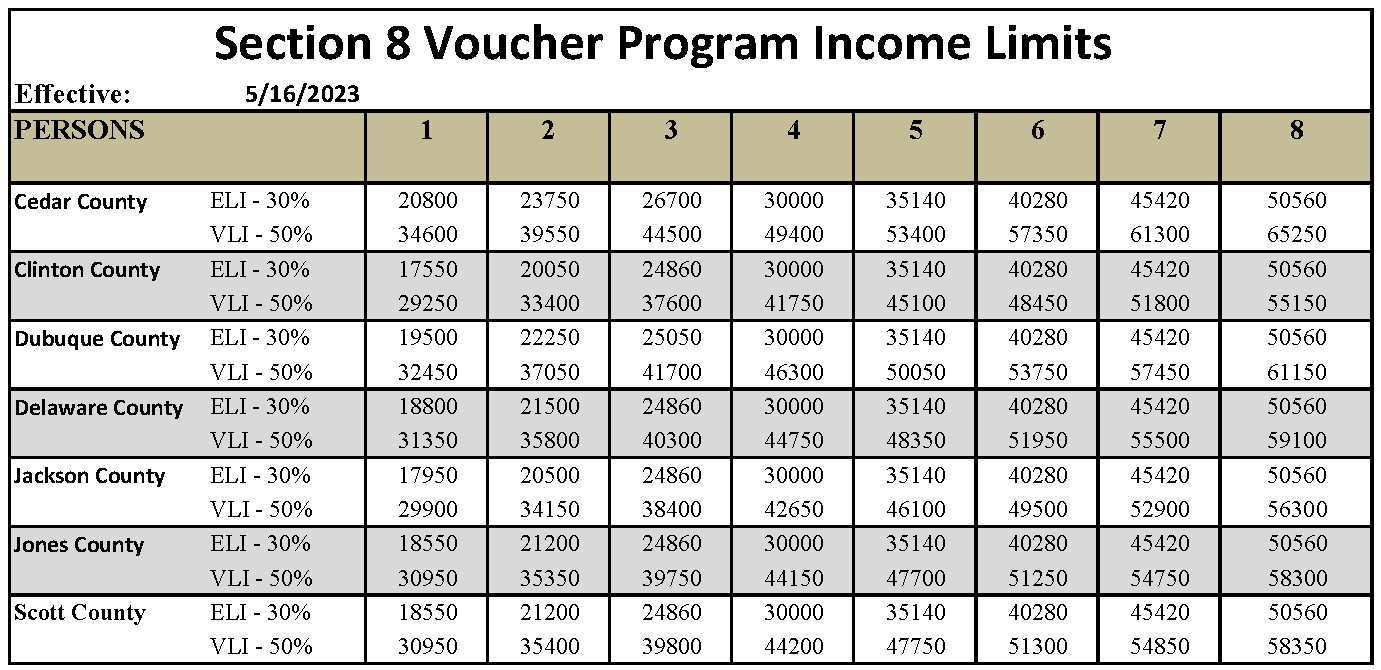

Qmb 2024 Limits Jolyn Ophelia, 31, 2024, and prior to dec.

Source: isabelqtallulah.pages.dev

Source: isabelqtallulah.pages.dev

Illinois Nol Limitation 2024 Orly Pansie, 31, 2024, and before dec.

Limits For Medical 2024 Kary Sarena, Illinois limits the nol deduction (again), among other changes.

Source: danielewcarina.pages.dev

Source: danielewcarina.pages.dev

2024 Medicaid Limits Illinois Lark Aurelia, Hb 4951 will extend the corporate income tax nol limitation in illinois to tax years ending on or after dec.

Source: adanqkessia.pages.dev

Source: adanqkessia.pages.dev

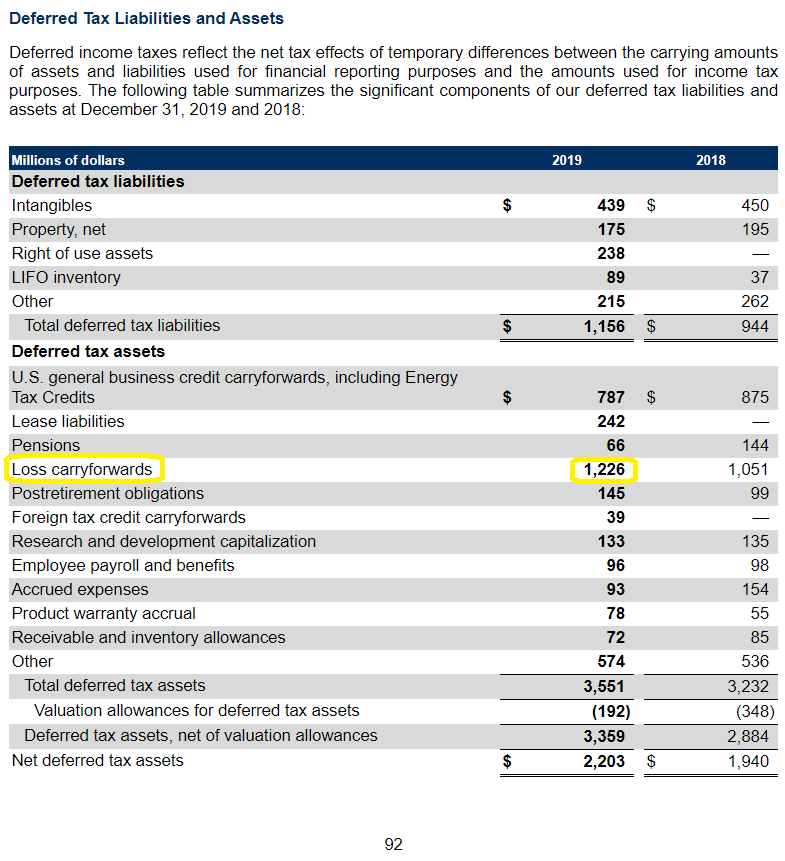

Corporate Charitable Contribution Limitation 2024 Selma Danyelle, Under prior law, the utilization of nol carryover corporations other than s corporations was limited to $100,000.

Source: vikiqgloriana.pages.dev

Source: vikiqgloriana.pages.dev

Utah Snap Limits 2024 Idalia Raquela, Article 105 of hb 4951 would impose a $500,000 per year cap on net operating losses (“nol”) available for use against corporate income taxes at $500,000 per year.

Category: 2024